Easy Seg

A tool for enhancing and categorizing payment data based on purchasing behavior, allowing banks to benefit from better customer insights.

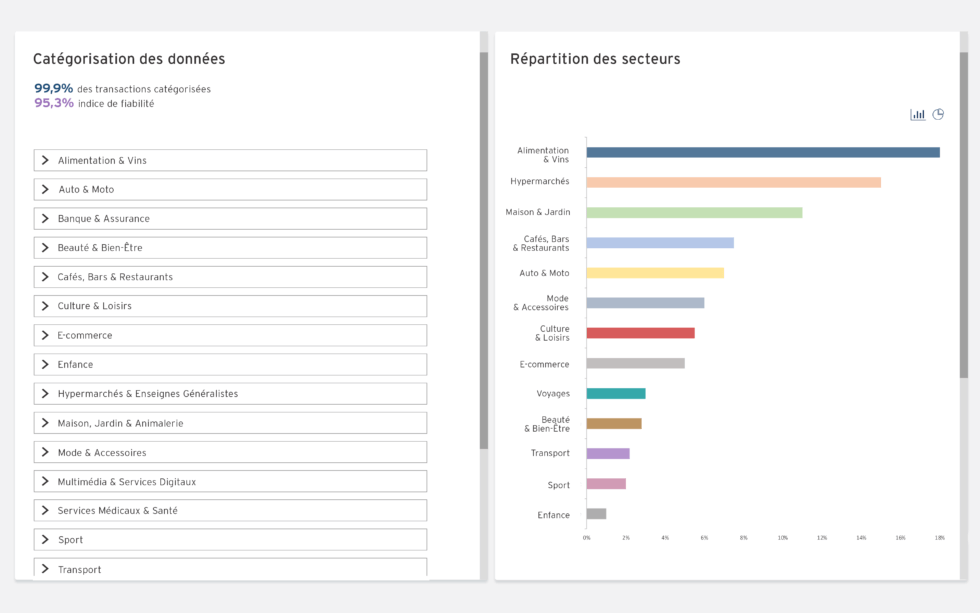

activity categories

of expenses categorized

Benefits

With EASY SEG, banks can exploit the full potential of payment data and obtain valuable insights into the consumption habits of their customers.

For the Bank’s Marketing & CRM teams

For the Bank’s Risk & Fraud teams

An essential tool for identifying and targeting customer segments based on their purchasing behavior in order to offer a personalized banking experience.

By identifying the consumption habits of its customers, the bank can detect unusual transactions and prevent card fraud.

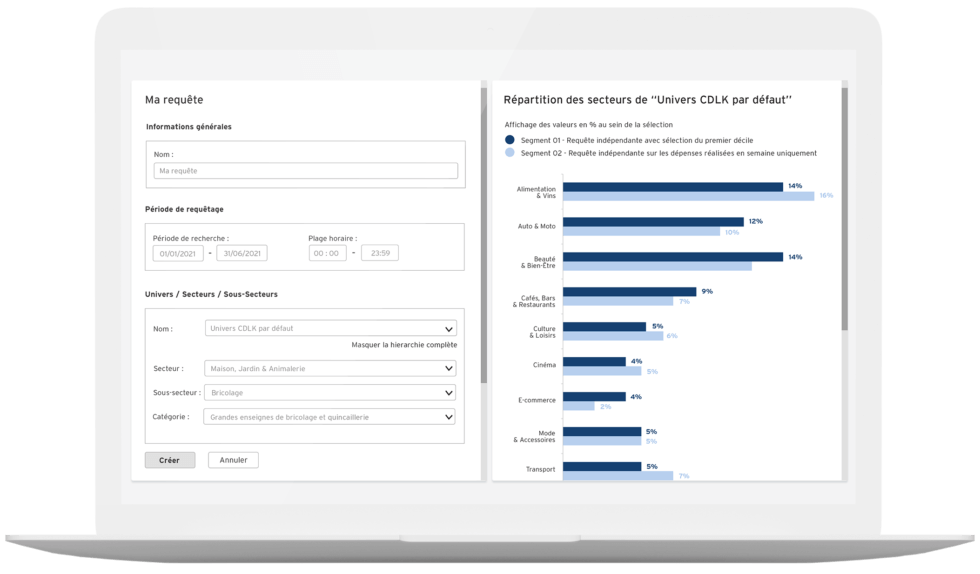

How does it work ?

EASY SEG addresses what has historically been difficult for banks to do : categorize expenses correctly. The solution is based on an intelligent categorization of payment data, with a level of completeness and accuracy close to 100%.

Data Enrichment & Customer Insights

Use case : developing intelligent client segmentation